Merry New Year

Global trade restructuring, manufacturing optimism, moribund services, monetary policy working at cross purposes

This week’s note is abbreviated; we preview a return to the regularly scheduled employment week data releases for the first time since the shutdown. We also review the December regional Federal Reserve Surveys and offer some thoughts on the residential real estate market, global trade rebalancing and the poorly named debasement trade.

If you tuned out markets during the holiday period, good for you and here are the links to our three year-end strategy notes to help get you focused on 2026.

2026 Outlook: Duration Tightening

Macro Themes: Reversing Financial Statism

2025 in Review: Surprisingly Stable Inflation

Merry New Year

Next week we (finally) return to the Bureau of Labor Statistics regular scheduled macro data programming. On Monday we get December ISM manufacturing and vehicle sales. Wednesday brings December ADP Employment and ISM Services and the November Job Openings & Labor Turnover Survey; we will release a preview note for Friday’s December Employment Situation report following the release of JOLTS. There are two relevant reports due Thursday, the first, 3Q productivity, will look exceedingly strong, however we remain skeptical of the 3Q GDP strength, gross domestic income was considerably softer, and we strongly suspect the production numbers overestimated underlying demand.

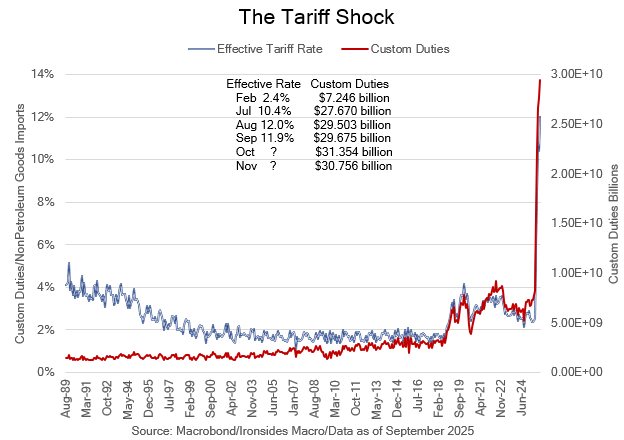

The second report, October trade, is important inasmuch as we are trying to determine the effective tariff rate and whether the massive goods deficit has stabilized or begun to contract in response to the increase in the effective tariff rate from 2.4% in February to 11.9% in September. As our first chart shows, custom duties have been relatively stable at $30 billion per month since August. One interesting development over the holiday period was the offshore yuan (CNH) rallying through 7, unlike round one of the US/China trade war the Chinese did not devalue their currency as an offset to increased tariffs. As we half listened to financial television over the holiday period, we heard lots of commentary about the Supreme Court IEEPA decision causing ‘volatility’ (a nonsensical characterization), although the legal ramifications of a ruling to uphold the Court for International Trade ruling could be significant, one way or another the tariffs are here to stay. What we haven’t heard much about is whether the Trump Administration’s tariffs will lead to a global trade restructuring, import substitution, manufacturing onshoring or just a net loss in economic efficiency.