May Payrolls Preview

Dubious openings, the end of the Great Reallocation, U3 is a lagging indicator

The Fed’s Trilemma

The initial inversion of the 2s10s nominal rate curve in April 2022 was driven by a 200bp inversion of the breakeven inflation curve. In essence, the market correctly forecasted peak inflation as well as a sharp increase in 10-year real rates. The current 76bp inversion of the 2s10s curve is attributable to a 96bp inversion of the real rate (TIPS) curve. This highlights the Fed’s Trilemma, as well as the suboptimal tightening strategy. Inflation is above target, the unemployment rate is below the Fed’s estimate of the equilibrium level (u*) and following the upside surprise in job openings, financials led the S&P 500 lower due to the current policy rate being above the financial stability rate (r**). In other words, if the Fed chooses to focus on the unemployment rate, a component in the Conference Board’s Lagging Indicators Index, ahead of a flood of Treasury supply and significant evidence that the policy rate breached the financial stability rate in 2022, they risk a nonlinear credit contraction. Bank equity prices will come under another round of aggressive selling (bear raids dare we say). We heard today from the administration’s nominee for the Vice Chair for Monetary Policy, Philip Jefferson, that he supports a pause or skip if you insist on using this curious Fed framework. Here is a key passage from his speech.

“I expect spending and economic growth to remain quite slow over the rest of 2023, due to tight financial conditions, low consumer sentiment, heightened uncertainty, and a decline in household savings that had built up after the onset of the pandemic. Inflation has come down substantially since last summer, but it is still too high, and by some measures progress has been decelerating recently, particularly in the core services sector. While it is reasonable to expect that the recent banking stress events will lead banks to tighten credit standards further, the amount of tightening and the magnitude of the effect such tightening might have on the U.S. economy is not yet clear, and this uncertainty complicates economic forecasts.”

Financial Stability and the U.S. Economy

It appears to us that the leadership of the FOMC has gained an understanding of the financial stability risks and is likely to push the committee to pause in June. That said, Friday’s May employment report still looms large ahead of the quiet period beginning Saturday.

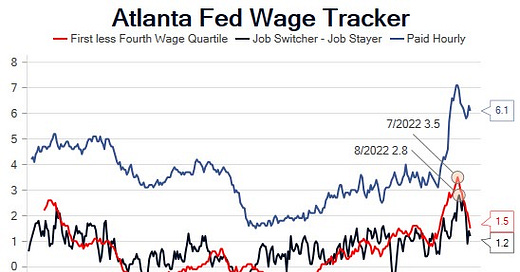

Another regional Federal Reserve Bank’s research department, San Francisco, published research questioning the contribution of wage growth to above target inflation this week. Incoming labor market data since the April employment report has been mixed; jobless claims spiked higher in early May before reversing. Regional Fed manufacturing and services employment and hours worked surveys were little changed near the expansion/contraction line. April job openings were higher, but hiring was flat and quits fell. The curious 1Q increase in the Atlanta Fed Wage Tracker reversed in April, and interestingly the spread between the lowest and highest income quartiles and job switchers and stayers both contracted, implying that slack increased and fluidity (churn/reallocation) contracted. In sharp contrast to the April increase in job openings, the Conference Board’s May consumer confidence survey respondents characterizing jobs as plentiful fell 4%, pushing the labor differential (jobs plentiful less jobs hard to get) to a level consistent with a 3.9% U3 unemployment rate.

Consensus expectations are for 195,000 nonfarm payrolls, a marginal increase in the unemployment rate to 3.5%, a cooler increase in average hourly earnings than the curious April 0.5% increase of 0.3% and unchanged participation rate of 62.6%. Our work on slack implies upside risk to the unemployment rate and our worker reallocation model points to marginal downside to the consensus average hourly earnings forecast. We don’t have much conviction about total employment growth beyond a general weakening labor demand trend evident in slowing total labor income. Participation has been positively surprising all year so another increase would be consistent with the trend. On balance we don’t expect a report that would tip the scales towards a hike in June with supply looming and bank credit growth slowing sharply.