March Payroll Preview

Small business employment, services demand, increased slack, Good Friday surprise?

We are going to keep this preview a bit shorter than usual and write a more extensive review following Wednesday’s ADP report, Thursday’s jobless claims revisions and NFIB Small Business Employment Survey and Friday’s March employment report. We suspect the strong headline payroll gains in January and February were misleading, demand for labor is slowing.

Stall Speed

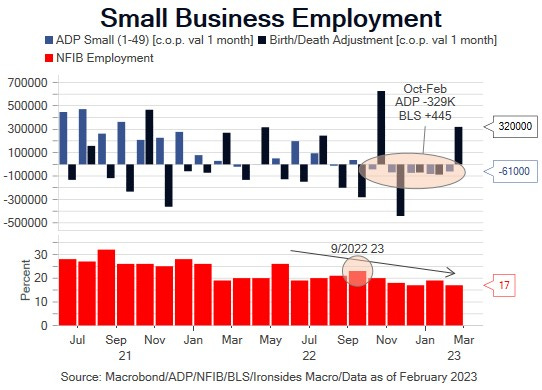

It appears to us that the manufacturing and housing contractions, combined with slowing demand for services, as the pandemic goods to services spending rebalancing runs its course, is catching up to the labor market. We are particularly concerned about the portion of the labor market the BLS monthly report doesn’t measure well in real time, small business employment. As we detailed following the February report, the BLS birth/death adjustment to the aggregate data, a proxy for small business employment, added 445,000 jobs since September in a highly erratic pattern, while the ADP employment report showed small business employment (1-49 employees) contracting 5 consecutive months for a total of 329,000 with a monthly range of 43,000 to 83,000. The NFIB Small Business Survey is also contracting, in September the net number of companies adding workers was 23%, it fell each month except January to 17% in February. The consistency of the patterns in the ADP and NFIB reports relative to the BLS model looks convincing. We are skeptical of the strength in headline payrolls in January and February due to questions about seasonal adjustment factor pandemic distortions and slowing total labor income due to flat hours worked and cooling wage growth. As we noted previously, the financial crisis caused a pattern of soft 3Q and strong 4Q employment growth that persisted through 2015. It took the FOMC years to adapt, they eased into strengthening growth in 2010, 2011 and 2012. It appears to us that they are tightening into slowing growth in 1Q23.