Transitory Volatility Backwardation

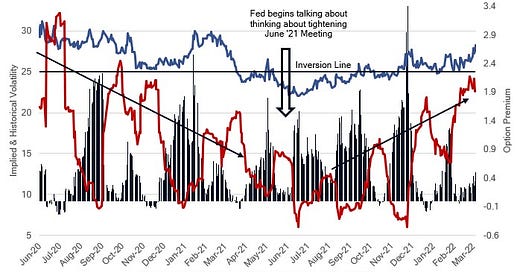

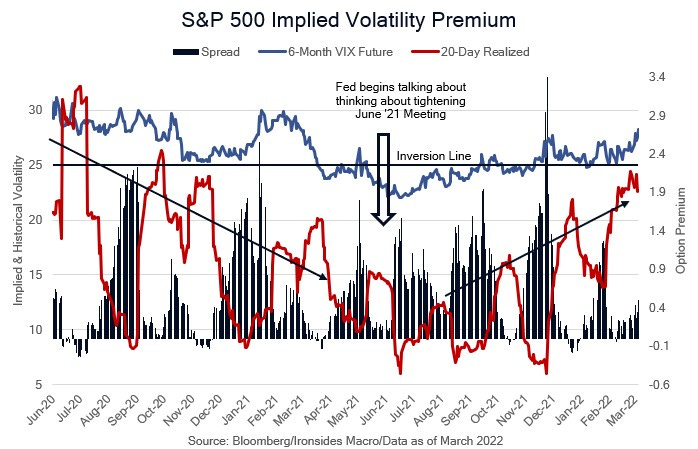

We are headed into a weekend with another dose of risk-off; VIX 1-month futures are trading with a 4% premium to the 6-month contract (backwardation), 7% richer than normal and the Emerging Market Volatility Index is 41%, 3 standard deviations above its median level. Dean Curnutt, the CEO of Macro Risk Advisors, notes that VIX curve inversions are generally short, they require realized volatility of ~25% (1.6% daily moves). For that reason, most last 1-2 weeks, exceptions were a 7-month inversion of the 1-month, 3-month curve during the Global Financial Crisis, and 2.5 months during the European Sovereign Debt Crisis and the early days of the Pandemic. Elevated measures of risk, including the VIX curve inversion, are understandable following the Russian Army’s assault on Ukraine’s largest nuclear power plant ahead of a weekend with no obvious Putin off ramp. That said, as we will discuss later in this note, the Fed policy normalization correction and Russian risk-off episode has reset equity market valuations to reasonable historic levels, made Treasuries even more ridiculously overvalued and is unlikely to have a significant impact on earnings. It is early to reach strong conclusions about the impact on growth and inflation, however Friday’s employment report implies 1Q22 gross domestic income is quite strong as the Omicron wave passes and we do not believe consumer or business confidence channels are vulnerable to a negative shock from the Russian Invasion. We remain bullish equities and bearish Treasuries.