July Payrolls Preview

Surveys and wage measures divergences, the stall in the participation recovery

Note: Saturday’s note is likely to be delayed until Sunday or Monday morning

Three Questions: Which Survey, Wages, and Participation

With the Fed having completed the ‘front-loading’ stage of the tightening cycle, labor market data will move back toward center stage for two reasons. The first is obvious, in the longer run when the Fed faces a trade-off between employment and price stability, political pressure and human nature will lead to a greater weight on employment. This has been true since the Kennedy Administration with the exception of the Volcker Fed, but it took a decade of inflation to create the conditions that made Volcker’s policy regime possible. The second factor is based on the standard Keynesian demand driven inflation model: wages, less productivity, equals consumer price inflation. There is no doubt the Powell Fed views price stability as their primary focus in 2022, we are not questioning their commitment to price stability, rather looking forward towards a rebalancing of the FOMC mandates.

If we analyze the labor market impact on the inflation outlook, consider the four major components of consumer price inflation: energy (7% of CPI), food (14%), core goods (21%) and core services (58%). We know that agriculture and energy futures prices as well as core goods prices have fallen sharply from peak levels this spring. We know less about core services prices. Housing activity has slowed, consequently, shelter measures are likely to flatten out and retrace some of their gains, albeit with a considerable lag. Demand for services is strong as evidenced by the July ISM Services Survey, which brings us to the labor market and wage pressures.

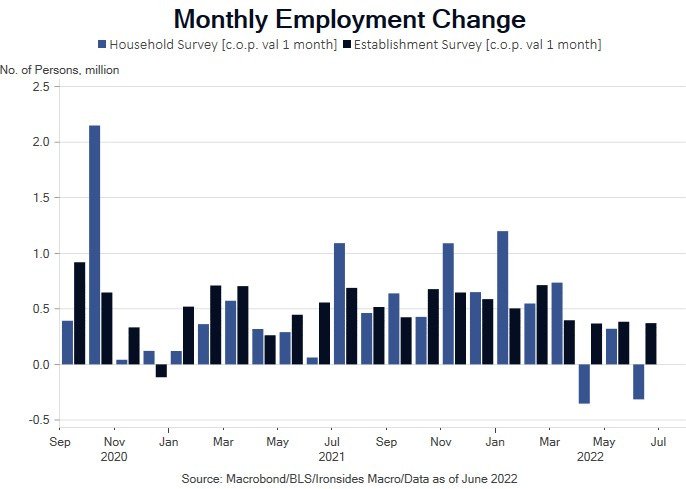

There are three important questions we expect Friday’s July Employment Report will help to resolve. The first question is about demand for labor, is 2Q22 softness in household survey, despite continued strength in the establishment survey, capturing a turning point? The second question is about the intersection of supply and demand, the price for labor. The average hourly earnings series decelerated steadily in 2Q22, however the Atlanta Fed Wage Tracker and Employment Cost Index did not. The third question pertains to the supply of labor, participation was recovering towards pre-pandemic levels for prime age workers early in the year until a curiously large flow from employed to out of the labor force in June led to a sharp setback. Wage growth is the fourth leg of our peak inflation thesis. An optimal report would show a resumption of the recovery in participation (increased supply), wage growth deceleration and marginally softer demand, however as we will explore in this note, there were some considerable shifts in the June report that defy simple explanations.