Inflation Lights a Political Fire

Inflation Politics, QT is not the same as QE, liquidity vs duration, CPI details

Goods Inflation Peaked, Services and Political Heat Still Rising

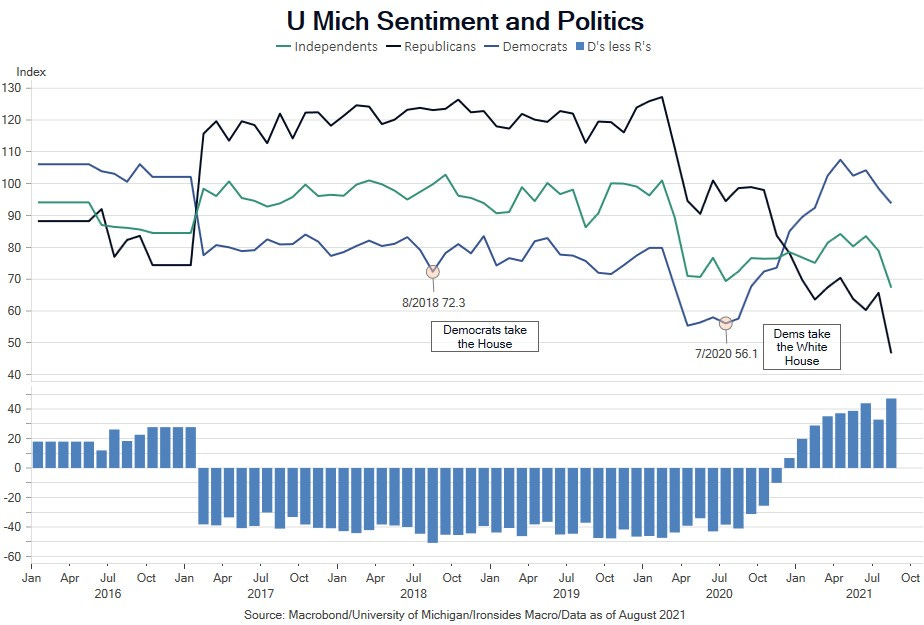

As we reflected on Friday morning’s events, the more we thought about it the more we concluded that the more important report was the University of Michigan Consumer Sentiment Survey plunging to an all-time low, rather than the hotter-than-expected May CPI report. We have long viewed consumer confidence surveys as far more useful in forecasting elections than consumer spending. Plunging confidence, Presidential approval and direction of the country polls are all being driven by inflation. There’s always a crisis in Washington, but this time it’s a big one and the public appears to tie inflation directly to 2021 fiscal and monetary policy stimulus. As we will explain later, the CPI report did not significantly alter our view that inflation has peaked. Goods inflation, the direct result of overzealous pandemic non-pharmaceutical interventions, is slowing quickly. However, inflation resulting from the excessive US fiscal and monetary stimulus that turbocharged demand for interest rate sensitive housing and autos drove faster than expected all items (headline) and core inflation. While these sectors are most responsive to monetary policy, it works with long and variable lags. In the meantime, the evidence of a political crisis in the University of Michigan Survey may well, and perhaps should, push the FOMC to accelerate the front-loading of rate hikes.

We have long argued that the evolution of Fed communication strategy has been counterproductive. The 2004-2006 measured removal of policy accommodation exacerbated the malinvestment cycle, forward guidance and QE in the ‘10s impaired capital investment by creating a series of mini booms and busts in business confidence. With consumer confidence at all-time lows due to the highest inflation in 4 decades and business confidence on a similar trajectory, the Fed desperately needs to restore credibility following their massive 2021 policy mistake. We suggest channeling the Volcker Fed with a hawkish surprise: not with forward guidance, instead with policy action. We would prefer they pull forward maximum balance sheet contraction caps and sell mortgages outright; but the more likely, though still not probable outcome, would be a 75bp policy rate hike. As we explain in this week’s note, QT is considerably more passive than QE particularly in terms of the impact on longer term rates. The Fed’s balance sheet is a potentially potent tool to cool excess demand in housing and autos if they would only use it.