Inflation Backwardation

The global conundrum, inflation backwardation, shock therapy, maturity transformation and financials

The Global Conundrum

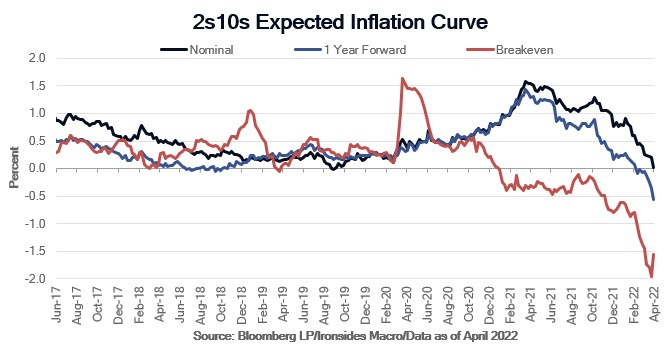

The inversion of the 2s10s nominal Treasury curve is not implying slower growth, but rather lower inflation in 2023 and beyond. This counterintuitive assertion, if correct, explains the sharp post-FOMC equity market rally alongside higher rates led by the front end, and is consistent with our analysis of the hawkish Fed pivot and incremental increase in credibility. Imbedded in yield curve inversion recession risk mania this week is a dubious assumption: the level and direction of longer maturity Treasury yields, particularly the non-inflation or real component, has not been a reliable growth indicator since the globalization boom caused the conundrum in the mid-’00s. From October 2003 through March 2004, $340 billion of Japanese currency intervention combined with a 30 trillion yen injection of bank reserves (Japan’s QE1) drove 10-year Treasury yields from 4.6% to 3.7% despite ISM manufacturing increasing from 52 to 61 and core CPI rising from 1.1% to 1.9%. Rates bottomed the day after the last round of intervention, two weeks prior to the first big employment increase of the cycle. The proceeds were invested in US Treasuries thereby creating a synthetic QE program.

Over the next two years during the Fed’s measured removal of policy accommodation, the 2s10s and 3m10y curves flattened until 1Q06 when the BOJ ended the original QE and drained 30 trillion yen of bank reserves. By the end of 2007 the 2s10s Treasury curve had steepened from a 13bp inversion to 97bp. So much for forecasting recession, the 2s10s nominal curve steepened 100bp in the 18 months prior to the NBER’s recession date. The Japanese had some company in those days, the Chinese current account surplus was exploding from 2% to 9% of accelerating GDP (9% to 15% growth). The hard dollar peg until mid-2005 required large dollar purchases to prevent yuan appreciation. The crawling revaluation beginning in mid-2005 slowed, but didn’t end, Chinese demand for dollars and US Treasuries. Additionally, Fannie Mae and Freddie Mac were facilitating the housing boom by growing their retained portfolios of mortgages to $1 trillion each while buying the majority of the super senior tranche of subprime collateralized debt obligation (CDOs) deals. Consequently, Japanese and Chinese exchange rate policy, with an assist from Fannie and Freddie, played a major role in the nominal yield curve flattening. In November 2004 Chairman Greenspan uttered his infamous quote: "Rising interest rates have been advertised for so long and in so many places that anyone who has not appropriately hedged his position by now, obviously, is desirous of losing money". This was to be coined “the conundrum” by Greenspan and the global savings glut by Ben Bernanke. Turns out this was merely a preview of the impact of policy on nominal and real yields as well as implied volatility when QE crossed the Pacific. Real rates ceased providing information about growth, as central bank policy increasingly distorted the most important price signal in the market economy. The distortions began in the Far East, spread to the US during the financial crisis, and Europe following the near collapse of the EU.