Inadvertent Monetary Policy Rebalancing

Big Tech's Moat, Fed Policy Rebalancing, Weak Capex, Healthcare Disruption Resistance

We’re Going to Need a Bigger Moat

We expected to focus on macro data releases, auctions in the belly of the Treasury curve, the FOMC meeting and earnings from big tech last week. Instead, the Deep Seek Gen AI development and RFK hearings with the related potential for significant disruption for the healthcare and food sectors added to an interesting week. The data didn’t change our outlook, the capital spending component of the 4Q advanced guesstimate of GDP was disappointing, but capital spending plans are recovering sharply from pre-election uncertainty. Wages and inflation are cooling and demand for labor remains soft, consequently, we strongly suspect the Fed will resume what we are labeling policy rebalancing by the May meeting, with March a higher probability than the market’s 17% assessment. The FOMC did not plan or expect 10-year rates to increase 1% while they were reducing the policy rate 1%, however, the disinversion of the Treasury curve rebalanced policy to a more equitable distribution between fixed and floating rate borrowers, large and small banks, investment grade and high yield companies, and homeowners and renters. As we explain in this week’s note, the rebalancing process is incomplete, QT could run through all of ‘25, thereby returning $500 billion of Treasuries and mortgages back to their rightful private sector owners. Additionally, the Bessent Treasury Department is unlikely to finance $2 trillion deficits with 30+% of short-term bills. Consequently, we continue to expect the Fed to reduce the policy rate by an additional 1% in ‘25.

The Deep Seek shock raised crucial questions including whether innovation is truly concentrated in large companies as papers presented at the 2018 Jackson Hole Economic Policy Symposium and the relative value of the capitalization indices suggest. Importantly, for equity investors, the crucial question is whether the large companies fueling the incredible growth in Nvidia’s products, will earn a reasonable return on investment. With the technology and communication sectors accounting for 40% of the capitalization of the S&P 500, any money manager whose performance is benchmarked has to consider whether the moats have been breached. Was Deep Seek a sputnik moment, or is it a trojan horse set on us by the CCP? We were struck by the data sharing required by the model. Consequently, we did not contribute to the app’s ascendency in the Apple Store and are of the mind that as these models become increasingly affordable and revenue enhancing, not just cost saving, large companies will protect their data by building their own infrastructure. In other words, the energy demand story remains intact, and perhaps even solidified. In summary, we are not considering reducing our energy and material sectors overweights, but our market-weight exposure to technology and communication services, 40% of our equity allocation, has always been uncomfortable, and following the emergence of Deep Seek, is increasingly so.

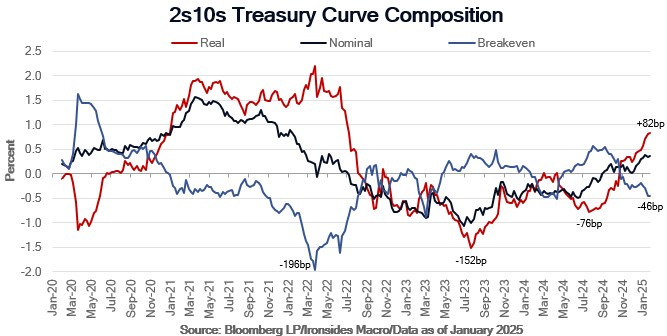

One month into ‘25 the equity market is off a strong start, with more equal distribution across capitalization and sectors, the Treasury yield curve has undergone a modest parallel shift lower, performance consistent with the Fed’s inadvertent policy rebalancing. As you can see from the chart below, the benchmark 2s10s Treasury curve divergences during the pandemic policy panic inflation price level shock and Fed’s passive QT and aggressive rate hike process have been extreme. Beneath the surface in early ‘25, despite all the screeching about inflation risk from increased tariffs, the breakeven inflation curve, has continued to flatten and is signaling lower inflation. The breakeven inflation curve was deeply inverted in April ‘22, CPI and PCED peaked two months later.

In this week’s note we review the capital spending outlook, provide our case for additional monetary policy rebalancing including updates on the Fed’s inflation and employment mandates, cover the latest on the threat to bureaucracy from RFK, and finish with earnings and other equity market developments.