Housing is Not Yet in Balance

BOJ, sentiment, favorable inflation and growth data but an unbalanced housing market

Apologies for the late publication of this week’s note, we will be back on schedule next week. Additionally, be on the lookout for a payroll preview note on Tuesday.

Mostly Good News

The inflation, wage, growth composition and earnings data, combined with an FOMC that appears close to declaring a truce with the yield curve, created a sufficiently favorable environment to more than offset the Bank of Japan’s yield curve control band widening Thursday night. We hear a lot of chatter about excessive optimism, and the AAII Survey does indicate individual investor optimism. But our what they pay, rather than what they say approach to sentiment and positioning finds the volatility and correlation markets mixed and hedge fund returns generally negatively correlated with the major equity indices, implying they are short. Last week’s events increased our confidence the next stop for the S&P 500 is 4800, a full round trip following the 27% drop in 2022.

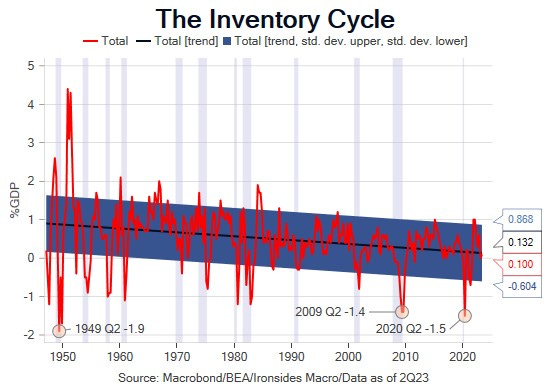

Last week’s macro data was favorable in terms of the outlook for disinflationary growth. Thursday’s 2Q advanced GDP guesstimate illustrated the favorable mix; the GDP price index (deflator) was 2.2%, down sharply from 4.1% in Q1 and well below consensus of 3%. The core personal consumption deflator cooled from 1Q’s quarterly annualized pace of 4.9% to 3.8% and on Friday we learned the June monthly increase was 0.165%, much cooler than May’s 0.309% reading. GDP increased 2.4%, slightly faster than 2% in 1Q, and while at first glance you might think this is an issue for the Fed, the mix was much improved with personal consumption slowing from 4.2% to 1.6%, government spending easing to 2.6% from 5% and nonresidential fixed investment accelerating from 0.6% to 7.7%. We realize the Eccles Building is not a denizen of supply siders, but robust spending on structures (9.7%), equipment (10.8%) and software (7.4%) despite depressed business confidence and restrictive monetary policy improves the outlook for productivity. The wild pandemic inventory cycle appears to be complete; inventory investment was flat in 1H23 and is right on our long-term trend line. Cooler personal consumption spending was primarily attributable to autos, although services spending slowed from 3.2% to 2.1% with a notable 3% decline in food service/accommodation spending. Nominal growth eased from 6.1% to 4.7% and to further underscore our favorable mix view of the report, personal consumption contributed 1.12% to the 2.4% increase in real GDP, but the much smaller nonresidential fixed investment category (14.9% of GDP vs 70.6%) contributed 0.99% to growth. In short, the dynamic US economy appears to be on the verge of overcoming the largest monetary, fiscal and public policy mistakes in our nearly four decades as a market participant.