Hayek Shrugged

Debate Debacle, Chevron Deference Demise, Joe Six Pack's Real Wage Struggle, Capex Plans and Labor Demand Weakening, Portfolio Update

Policy Calculus

We first wrote about the ‘60s analog in June ‘21 and since then have frequently returned to the decade of strong growth, capital investment and earnings, combined with rising government spending and inflation that led to positive equity returns despite an acceleration of the three-decade bond bear market. As we watched President Biden’s probability of reelection plunge in the election markets (to ~20%) by far more than former President Trump’s chances increased (~60%) during the presidential debate Thursday evening, the ‘60s analog took on more meaning with an LBJ withdrawal for President Biden no longer a tail event. Consequently, the policy calculus just got more complicated. We know with reasonable certainty the policy agenda of the two candidates as well as the probability of implementation that is skewed by the Senate math that favors the GOP. The unknown unknown is what direction the party will take if President Biden goes the way of LBJ. Given that no list of swing states includes California, we suspect a candidate from the Golden State would have as much electoral success as Hubert Humphrey. For now, the Trump trades, long financials, energy, healthcare, merger arbitrage, stronger trade-weighted dollar, and short fixed income duration, are likely to gain momentum.

As tumultuous as the debate was, the Supreme Court overturning the 1984 Chevon Deference decision was a victory for Hayek’s rule of law. Since the ‘84 decision we watched Congress pass a series of laws that did little more than create new agencies that were able to act as judge, jury and executioner. The Patriot Act, PPACA, Dodd/Frank and the Inflation Reduction Act are examples that handed a great deal of discretion to the administrative state. The trend of Congress abdicating their Constitutional responsibility came into focus during the Trump Administration when the President used laws passed, since the infamous Smoot-Hawley Law, under FDR, Nixon and Reagan, to implement tariffs to exercise a degree of discretion over trade policy the founders had no intention of granting to the President. As we understand the decision (credit to Mike McKee of Bloomberg — we have not had an opportunity to read it yet,) the decision does not apply retroactively to cases decided under Chevon due to stare decisis (precedent). Nonetheless, in our view this decision will force Congress to pass actual laws, unlike the Dodd/Frank fiasco that added complexity and made one of the US’s greatest strengths, our capital markets system, less efficient while creating an illusion of stability due largely to granting policymakers a much greater degree of control. In other words, it was a major setback for what Hayek called the ‘spontaneous economic order’.

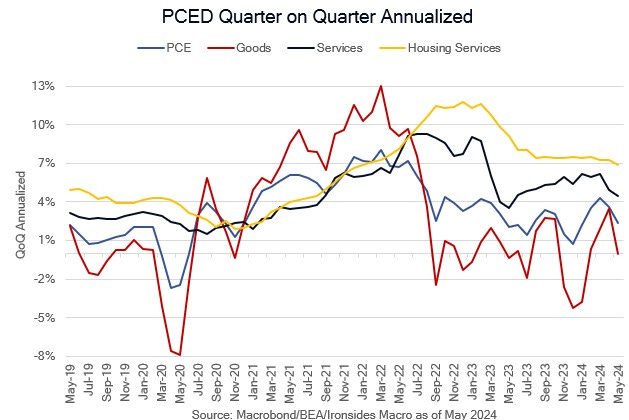

The last week of data moved the needle incrementally towards a September rate cut, not because of the immaculate disinflationary scenario of the Fed cutting because they can, but rather, the Fed missing on their full employment and cutting because they have to. To be sure the May personal consumption deflator (PCED), like CPI and PPI, was favorable, however, after those reports, we already knew the outcome of PCED. More importantly, May housing demand and core capital goods orders, June manufacturing capital spending plans, and June jobless claims and the Conference Board’s labor differential, all point to weaker business confidence and reduced demand for labor ahead of jobs week. We would not make much of equity market price action this week. The quarterly S&P sector rebalances on expiration a week ago Friday and the annual Russell rebalance, combined with an excessive amount of capital that has migrated from the investment banks to hedge funds to trade these rebalances (a business we were responsible for in the ‘90s) has led to a considerable number of counterintuitive price moves (index adds going down and vice versa).

In contrast, the modest bear steepening of the Treasury curve led by real rates (TIPS yields) is consistent with the increased probability of a second Trump Presidency. While we do not agree with the gang of 16 that tax cuts and government spending have a symmetrical inflationary impulse due to their dubious implicit assumption that government and private sector investment has the same positive impact on productivity, the burden is on former President Trump to offer viable plans to reduce spending to 20% of GDP and restore a primary surplus.

In this week’s note we will discuss the outlook for consumer spending and related equities, review the capital spending outlook, offer some early thoughts on next Friday’s June employment report and update our sector and asset allocation suggestions.

We will likely use this function this week for first thoughts during jobs week.