Global Stimulus Boom

Global Stimulus, China's Big Dig, Revisionism Revisited, GDI & Productivity, Putting Some Cash to Work Overseas

Global Stimulus Boom

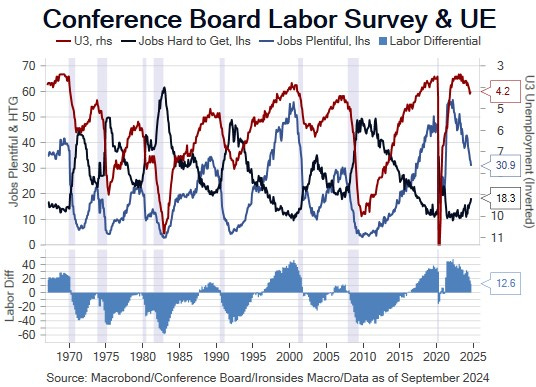

Last week’s economic reports, the Conference Board’s labor differential, preliminary September global and the S&P US PMI surveys, regional Fed manufacturing and services surveys and August New Home Sales, were consistent with our slowing growth outlook. The drop in the September labor differential (respondents characterizing jobs as plentiful less those describing jobs as hard to get) to 12.6% from 15.9% in August and 31.7% in January, implies an increase in the unemployment rate to 4.43% and underemployment rate to 8.2% in Friday’s September employment report. The soft data ahead of jobs week foamed the runway for the $69 billion of 2-year and $70 billion 5-year Treasury auctions, and both priced right at the when issued price, indicating strong demand. The one monkey wrench in our economic outlook this week was the Bureau of Economic Analysis revising the last 18 months of gross domestic income significantly higher due to an upward revision to corporate income in 2Q and compensation to employees in 1Q and in ‘23. As we explain later in this week’s note, the upward revision to GDP suggests the secular productivity growth boom, that began late last cycle due to accelerated technology innovation adoption, may be picking up steam. Stronger income in ‘23 and 1H24 is a positive for the capital investment outlook, however, the risk of rising unemployment becoming self-reinforcing and spreading to consumer spending, remains acute. Additionally, as we will discuss later in this week’s note, with earnings season two weeks away, the outlook continues to soften.

The FOMC decision to recalibrate their restrictive rate policy was a necessary, though not sufficient step, in relieving the pressure on small banks and businesses generally, the one part of the US economy where policy is restrictive. In our view, the FOMC needs to reduce the policy rate to 4% by the January meeting, in other words, match market expectations to mitigate the risk of recession. For large banks and nonfinancial corporates, particularly those benefiting from industrial policy, policy has been, and continues to be accommodative, due to longer maturity risk free rate and volatility suppression as a consequence of the Fed’s large holdings of Treasuries and mortgage-backed securities, as well as the largest non-recessionary or war-time deficits in US history. As we look towards 2025, US policy is likely to be more accommodative, unless the election brings a blue wave that leads to increases in the tax rates on income and capital.

The Fed’s rate decision and forward guidance appeared to clear the way for the Chinese Politburo to initiate a very large monetary and fiscal stimulus package. While we remain structurally bearish on China and do not think the government can reverse the real estate malinvestment bust, the overinvestment was too large and demographics too large a headwind, however policymakers willing to transfer debt to the sovereign balance sheet, as the US government did, can have profoundly positive effects on domestic and global markets. There may be another underappreciated easing, the central bank of oil, the Saudi’s, are rumored to be ready to increase production. Our sources note they never had an explicit price target, their approach is stability, but increasing production could offset increased demand from technology driven US energy demand and stabilization in Chinese demand. Stable energy prices could offset a reversal of the global Chinese deflationary impulse. One beneficiary of stabilization in Chinese growth and stable to lower energy prices is Japan.

US, Chinese, Saudi, and ECB policy easing could end the global manufacturing recession, providing a reprieve for export dependent economies, with an unintended consequence of reversing global goods deflation. The immediate investor reaction is focused on the growth implications as evidenced by equity markets rallying, but the stage looks increasingly set for a resumption of the secular bond bear market that began in August 2020. Our equity sector allocation was positioned well for this week’s policy developments; our largest sectors overweights are large cap industrials, energy and materials, with healthy exposure to technology and communication services. We suggest leaning into these secular themes and adding some international equity market exposure. Ahead of what we expect to be another weak employment report, it is too early to reset Treasury shorts in the back end of the market, but bear steepening is on the way as a consequence of global policy easing.