Get on With It

100bp of cuts coming soon, solid as quicksand labor market, the Fed finances the Treasury, inflation preview, leaning into rate cuts in equities and fixed income

(BN) TRADERS PRICE IN CHANCE OF HALF-POINT FED RATE CUT THIS MONTH

Let’s Get on With It

“Eleven Districts described little or no net change in overall employment levels, while one District described a modest decline. Seven Districts noted that firms were hesitant to hire workers because of weaker demand or uncertainty. Moreover, contacts in two Districts reported an increase in layoffs, while contacts in multiple Districts reported reducing headcounts through attrition—encouraged, at times, by return-to-office policies and facilitated, at times, by greater automation, including new AI tools. In turn, most Districts mentioned an increase in the number of people looking for jobs.”

Let’s Get On with It, Governor Christopher J. Waller

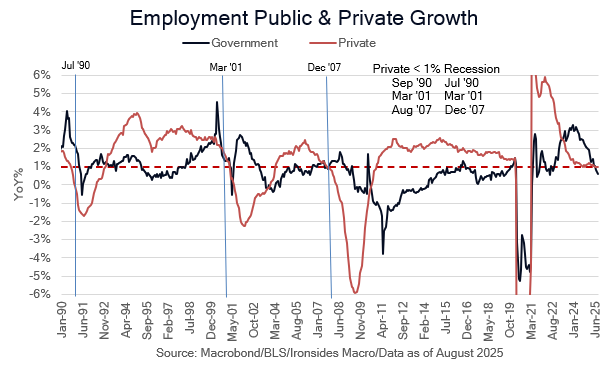

The 3-month average change in nonfarm payrolls is 29,000. If the first estimate of the annual benchmark revision of the establishment survey (Current Employment Statistics) for the year ended March ‘25 matches Governor Waller’s estimate of -60,000 per month, and the pattern persisted through August (the overestimation likely increased), job growth has been contracting since May. We’ve been consistent in our view that the Fed’s unbalanced policy tightening, passive QT and aggressive rate hikes, placed excessive stress on small banks, businesses and the housing market in particular. Their poorly executed tightening process weakened the foundation for the labor market, the BLS overestimation of small business employment has persisted for three years, and finally, the Trump Administration’s spending cuts, immigration reduction, and tariff increases has pushed employment growth below the 1% rate that coincided with the ‘91, ‘01 and ‘08-’09 recessions.

To be clear, we are not forecasting a recession, largely because the effective tariff rate (custom duties/non-energy goods imports) shock from 2.5% to 10.5% in July and associated uncertainty is largely, but not entirely, behind us. Additionally, the positive impact of corporate tax investment incentives is ahead of us, but mostly because we expect 100bp of easing by the end of January. If the first estimate of the annual benchmark revision of the establishment survey and CPI next week match our expectations, the FOMC could reduce the policy rate 100bp by December. When economists suggest the tariff effects are in the pipeline, they are referring to measured inflation and omitting the immediate impact of consumer company dynamic pricing models on aggregate demand. This is a dangerous approach that risks policymakers falling behind the curve on the Fed’s employment mandate. The market’s screamed in April the impact on aggregate demand was likely to be far larger than the rate of inflation. The FOMC has been focused on the wrong part of their mandate.

Our Payroll Preview note 3 days ago was notably downbeat, and the report realized our negative expectations. We discuss the details, dig into the Treasury market, which is approaching our 4% tactical target for 10s, update system liquidity amidst increased bill issuance, and make some tactical changes to our equity strategy as the Fed restarts the policy rate cuts.