Flawed Fed Frameworks

The fiscal theory, the hard data catches down to the soft data, excessive labor slack, the Fed is on track for a repeat of September '24, growth scare pullback likely

The Fed’s Flawed Frameworks

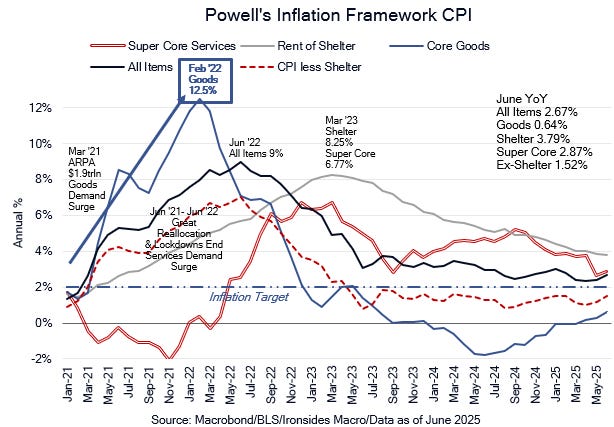

Treasury Secretary’s characterization of the FOMC being similar to someone who recently fell down, staring at their shoes, making them more likely to stumble again seems spot on. Our perspective is their fatal flaw is deeply rooted in the economic ideology of new-Keynesian economic thought. While most new-Keynesians will deny Milton Friedman was correct about anything, they appear to believe deeply that inflation is always and everywhere a monetary phenomenon. As one former Federal reserve director of research told us in 2019, the Great Moderation (80s, 90s, 00s and 10s) disinflation was virtually entirely attributable to Fed credibility. We couldn’t disagree more strenuously, the Great Inflation of the ‘70s and pandemic policy panic ‘20s inflation was always and everywhere, mostly a fiscal phenomenon. We appreciate why FOMC officials for political reasons do not want to discuss this publicly, but this blind spot appears to run far deeper. The week we learned federal government spending contracted 3.7% quarterly annualized in 2Q25, that followed a 4.6% decline in 1Q25, in 4Q24 it increased 4.0% and in the quarter before the election it increased 8.9%. Rather than sending households checks to boost growth like April ‘21 that was immediately followed by a spike in goods price inflation, government spending and employment are contracting. Disinflation is far and away the most probable outcome, the markets screamed that message in April and we agree.

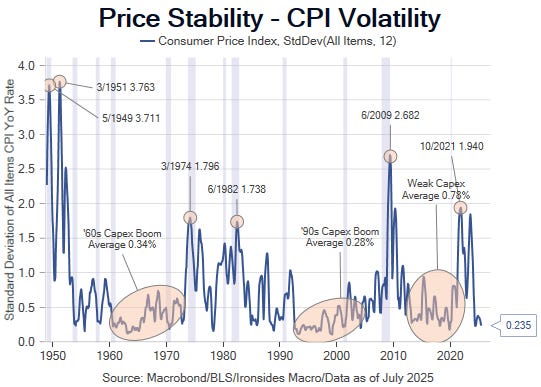

Another component of the FOMC’s flawed inflation framework is the 2% target. Their mandate is not 2%, it is stable prices, and they are meeting their objective. The median all items CPI rate since 1947 is 3%, the median standard deviation (volatility) of all items CPI is 0.58%. The current levels of 2.67% and 0.24% volatility exceed the objective of price stability. As our chart below shows, low inflation volatility (price stability) in the early ‘60s and the ‘90s were periods of strong capex and productivity growth. The third decade of relatively low inflation volatility, the ‘10s, did not see a capex boom. In our view a contributing factor to the weak capital investment in the ‘10s was misallocation of capital after the Fed launched their 2% target that led to excessive low real rates as the Fed attempted to increase inflation. The 2% target was enacted during a period of excessive obsession with policy efficacy at the zero lower bound, it was a mistake that led to malinvestment.

This week’s 2Q25 advanced estimate of GDP reinforced our fiscal policy approach to the inflation process. Private domestic final purchases eased sharply due largely to weaker services consumption. In short, the detox from the economy’s addiction to government spending, combined with the tariff tax, is disinflationary. This was obvious to market participants in April following Liberation Day when stock prices collapsed and the breakeven inflation curve got deeply inverted.

The Fed’s flawed frameworks and Chair Powell’s quest for a legacy have left the equity market vulnerable to a growth scare correction. We recommended buying equity and fixed volatility as well as the belly of the Treasury curve ahead of the July employment report. Last week we concluded the 10-year Treasury would breakout out of the 4.30% to 4.60% range to lower yields due to a deterioration of the growth outlook. We now expect a modest equity market correction, in part because the first three FOMC speakers, Cleveland Fed President Hammack, Atlanta Fed President Bostic and New York Fed President Williams doubled down on the labor market is solid and tariffs are inflationary narrative. Our case for looking through the detox was partially contingent on this week’s meeting beginning a communications pivot, instead we got patient obstinance. It appears Chair Powell hopes his legacy will be protecting Fed independence, it certainty won’t be astute monetary policy management.

In this week’s note we will review growth, employment, Treasury debt management and the outlook for markets.