February Payroll Preview

Payroll Haze, Seasonals Chaos, Small Biz Stress, Construction Rolling Over, Costanza Curves, Iceberg Risk

Payroll Haze

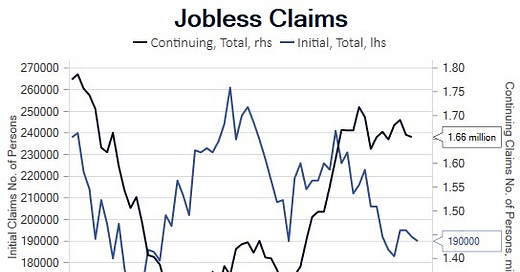

Since the January employment situation report, incoming labor market indicators have provided little clarity with respect to the primary focus of policymakers and market participants, the demand for labor. February Initial claims, Conference Board Labor Differential, ADP Survey, ISM Services Survey and Fed Services Sector Surveys implied decent labor market demand. ISM Manufacturing, Fed Manufacturing Surveys and job postings from Indeed and Zip Recruiter point to softer demand. Additionally, the recently restructured ADP report on small business employment contracted five consecutive months and NFIB Small Business Survey employment (February not yet released) has been softening, thereby adding to the suspicion that the BLS birth/death model is overestimating small business employment. Perhaps the divergence that best illustrates the payroll haze is the divergence between continuing and initial jobless claims. There appears to be consensus that the 517,000 increase in January net payrolls was overstated by seasonal adjustment factors distorted by the pandemic contraction and seasonably warm weather. We’ve heard less about the sharp increase in the work week that stalled the slowing trend in labor income, and we suspect there were similar distortions in that series as well. The persistent cooling of wages from the peak in 1Q22 is the most compelling argument that the January report was aberrational.

While the demand for labor, the primary focus of a Federal Reserve System dominated by economists schooled in Keynesian thought, is hazy, the release of the January JOLTS report confirmed a significant loosening of slack consistent with the persistent deceleration of wage growth. We remain convinced the surge in wage growth was attributable not to the Great Resignation, but rather the Great Reallocation. In other words, the pandemic created a generational opportunity for workers to change firms and industries. The reallocation created a wage level shock, however as reallocation slowed in 2022, wage growth cooled. Our reallocation model, which explains roughly half the boost in wage growth, is forecasting a return to pre-pandemic growth of ~3.5% in early 2024. The median for the change in nonfarm payroll of 69 estimates in the Bloomberg survey is 225,000, the range is 325,000 to 100,000. The median estimate for average hourly earnings is 0.3%, the range is 0.5% to 0.2%. The work week median expectation is for a 0.1 decline to 34.6, the range is 34.4 to 34.7. The February data has done little more than create a hazy picture for payrolls, however the trend is wages, and our reallocation model leads us to expect wage growth to continue to cool, job growth to slow, and the work week to reverse the curious increase in January. We will take the under on payrolls and the work week.