Earnings Good, Fed Bad

When doves cry, inflation correlation implies policy causation, consensus peak margins

Earnings Good, Fed Bad

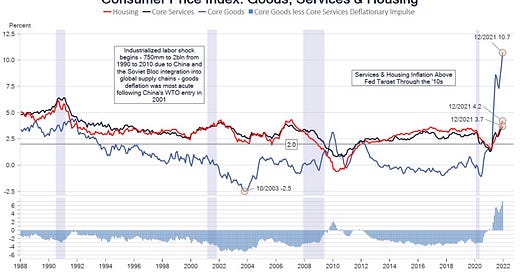

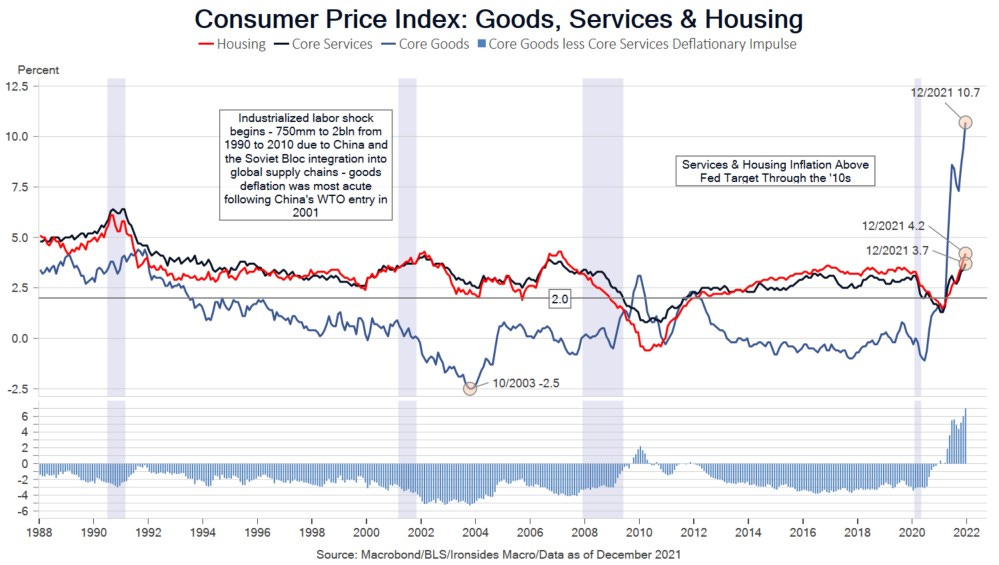

The markets’ favorable response to a series of hawkish FOMC participant public statements and a worse than expected consumer price index report, combined with a rally in the euro, yen, pound sterling, EM currencies, bitcoin, and technology stocks, along with stable real rates, all led to market participants and strategists forecasting peak inflation. The peak inflation narrative looks dubious with energy, copper, lumber and industrial metals rallying sharply. It appears even more questionable after considering that services disinflation is proving transitory and both inflation volatility and correlation are increasing at levels last seen in the ‘70s, implying that the drivers of inflation have transitioned from the pandemic to the lagged effects of the pandemic policy response. No doubt, the core goods inflation that jumped from 9.4% to 10.7% will peak in 2022. However, as goods price inflation recedes and demand for services increases, the FOMC will find themselves chasing 3.7% core services CPI as it moves even higher. The FOMC doves (Brainard, Daly and Evans) capitulated to the inevitability of multiple rate hikes and concurrent balance sheet contraction following the prior week’s employment report that in our view implies a labor market past NAIRU and last week brought another strong month for the Atlanta Fed Wage Tracker. Impressively, nominal 10-year Treasuries held their yield breakout above 1.7% and rallied impressively on Friday to close at a post-pandemic high of 1.78%. The valuation crunch in multiple of sales technology stocks has not yet evolved into a typical monetary policy normalization risk-off shock, that requires a highly correlated pullback across sectors. The risks of beginning 2022 with the 10-12% correction we expected last fall with the start of the monetary policy normalization process are growing.