Dropping Dynamite in the Ocean

Rising rate expectations fallout, fading Fed independence, LBJ's inflation, adding energy exposure

I’ll be appearing on Bloomberg’s The Open with Jon Ferro on Wednesday at 9am Eastern

Dropping Dynamite in the Ocean

Quietly, the Fed’s reduction of large-scale asset purchases began this week as the debate intensified about whether they should exercise the option to accelerate the taper process (The Fed must abandon average inflation targeting, William Buiter and What the Federal Reserve Should Do Now: An Elaboration, Jason Furman). The part of the Treasury curve most impacted by Fed purchases and interest rate policy continued to vote for faster policy normalization as evidenced by lower real rates and wider breakevens for maturities 5 years and in, even as crude oil declined amidst threats of sales from the Strategic Petroleum Reserve (SPR). Fed speeches were incrementally more hawkish as a couple of doves, Williams and Evans, hinted at 2022 hikes, and one hawk, Waller, called for accelerating the taper, faster removal of accommodation (rate hikes), then spent the bulk of his speech advocating balance sheet contraction. More significantly, Vice Chair Clarida also suggested there would be a debate at the December FOMC meeting over accelerating the taper pace. The widening of breakevens reversed on Friday following the Waller and Clarida speeches.

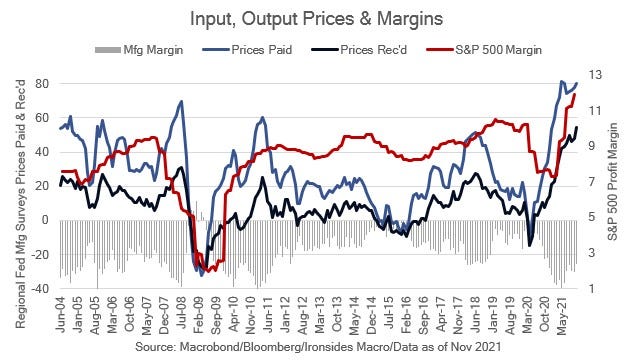

Incoming inflation data, October import prices and regional Fed manufacturing surveys of prices paid and received, strengthened the case that global supply chains will not provide the disinflationary impulse of the prior three decades. Recent drops in crude, Chinese coal, copper and shipping rates (Baltic Dry Freight Index) created some optimism that supply chains pressures are easing, however we expect easing pandemic related pressures to reveal a higher trend inflation rate in global goods and commodities. While it might appear that the equity market is ‘whistling past the graveyard’, the economic outlook continued to improve with October retail sales blowing away expectations, big box retailers reporting blowout consumer demand, strong November regional Fed manufacturing and national association of homebuilder surveys even as these sectors continue to struggle with tight labor and input supply. Critical to the divergence between equities and rates is the role of growth, which remains far more important to the direction of equity prices than Treasuries due to direct intervention of Federal Reserve, Treasury and foreign central banks.