Deglobalization

The retest, deglobalization, energy price passthrough, supply chains and capex and a preview of a big macro week ahead

It’s Still Primarily About the Fed

Fighting Inflation with Rate Hikes and Balance Sheet Reduction, Fed Governor Waller

“In the meantime, I would support having no caps on MBS redemptions so our MBS holdings decline as fast as prepayments allow, which would modestly assist in moving us toward an all-Treasury portfolio.”

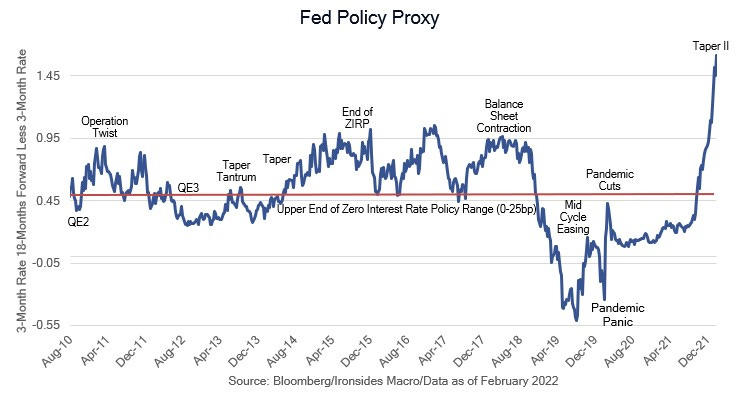

We had a less than 24-hour risk-off episode on Thursday with equities falling, but Treasuries, oil and the dollar rallying. On Wednesday and again on Friday rates were rising across the curve led by the front end, as you can see our Fed policy proxy continued higher through the Russian invasion. For the week the 3-month rate, 18-months forward less the spot 3-month rate (Fed Policy proxy) increased 15bp, 2-year note yields rose 13bp and 10s were up 6bp as the curve continued to flatten. All of this underscored how the Fed’s intention to primarily rely on the policy rate is tactically suboptimal, due to the flattening of the yield curve that will be less effective in cooling demand for housing, autos and durables. To be sure the build-up to the Russian invasion dampened sentiment and contributed to the retest of the appropriate adjustment to the monetary policy normalization cycle (it would be a misnomer to call it a tightening cycle). On Thursday morning we reached extreme levels on our equity market measures of risk, including a 500bp inversion (backwardation in commodity terminology) of the 1-month, 6-month VIX futures curve. We added exposure that morning, and we hope most of you followed our guidance and used the retest, actually marginal new closing low, to add equity market exposure as well. The rebound was driven by short covering as evidenced by the 7% rally in the Nasdaq 100 from the intraday low.

Our next chart, courtesy of Macrobond, shows the tendency for equities to rally once armed conflicts begin. Our perspective on the macroeconomic effects on the Russian invasion are mixed: we see little impact on US consumption even as oil prices rise further, in part because the Omicron wave is over, and hours worked are likely to surge in coming months beginning with next Friday’s February employment report. We will discuss later in the note our case for this being yet another supply chain shock, which strengthens our case for a capital investment boom that is well underway. However, the supply chain disruption to energy, industrial commodities and food will further boost trend inflation and the probability of a ‘70s regime, where energy price pass-through is much greater than the era when policymakers focused on core inflation, is rising.

One note before we move on, our work focuses on the investment implications of macroeconomic events, occasionally including geopolitics. While our assessment of the implications of the Russian invasion for US equities is relatively sanguine, were we writing about the longer run geopolitical implications, the note would have a much darker outlook. We have long given up on the ‘end of history’ outlook that developed after the collapse of the Soviet Union and Deng’s reforms. Ultimately, we believe the superiority of classic economic liberalism to central planning will lead to a collapse of socialism with Chinese characteristics and Putin’s autarky. Unfortunately, there is likely to be a considerable amount of human suffering in the interim.