December Payrolls Preview

Payrolls Still Matter, Slack, Churn, Fiscal Spending & Wages, Necessary & Sufficient

Please see this important note we posted on social media

Payrolls Still Matter

“Participants also discussed the role played by various supply and demand factors in the progress on reducing inflation thus far. They assessed that the contribution of improved supply had come from supply chain normalization, boosts to labor supply due to a higher labor force participation rate and immigration, better productivity growth, or increased domestic oil production. They also noted that restrictive monetary policy had helped restrain growth of demand, particularly in interest-sensitive sectors such as business fixed investment, housing, and autos and other durable goods. Several participants assessed that healing in supply chains and labor supply was largely complete, and therefore that continued progress in reducing inflation may need to come mainly from further softening in product and labor demand, with restrictive monetary policy continuing to play a central role. A few others saw potential for further improvements in supply.”

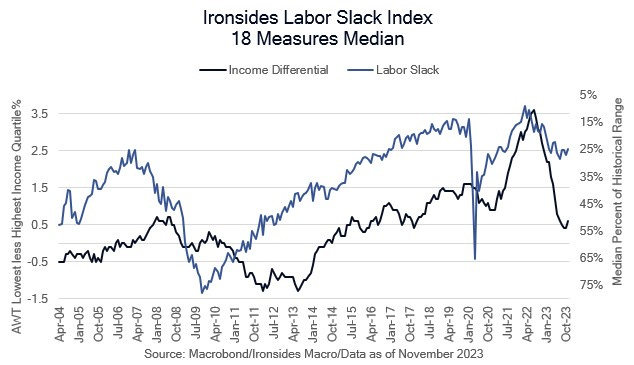

The December FOMC meeting summary of economic projections and press conference appeared to backtrack from the hawkish September meeting when we interpreted the Fed’s reaction function as continued disinflation was the necessary, but reduced aggregated demand and additional labor market slack were the sufficient conditions for policy rate cuts in 2024. We were looking for clarity from the release of the minutes but were left thinking there was less of a pivot to riding the disinflationary wave to easier policy than the market reaction implied. In other words, yield curve disinversion still requires at a minimum an increase in the unemployment rate, an outcome that will trouble the equity market given expectations for a reasonably strong earnings recovery (11-12% ‘24 growth) from the 4Q22-2Q23 shallow earnings recession. With today’s FOMC, likely heavily redacted, minutes restoring the Fed’s disinflation necessary, weaker growth sufficient condition for rate cuts, the 41 S&P point drop with 10-year nominal UST yields -2bp is logical. In essence, the probability of weaker growth or an accident due to the deeply inverted yield curve (3m10y banking model proxy 1.48%) went up today. Consequently, Friday’s report matters, but bad might be bad for equities given the post-December FOMC euphoria in small caps and financials in particular.

Expectations are for an easing of the change to nonfarm payrolls from 199,000 to 170,000 and private payrolls to 130,000 from 150,000. Keep your eye on the composition, government employment, has been exceptionally strong. Employment has also been robust in the sector with the softness wage growth, healthcare. Both of these sectors are drags on productivity and corporate earnings and margins. Net revisions to the prior two months have been negative 10 of the first 11 months of 2023, implying overestimation of smoothing models. Initial and continuing jobless claims were stable in December, as were regional Fed manufacturing and service sector surveys. ADP has been running below the BLS establishment survey for three months. Consequently, the risks are marginally skewed towards a softer report. We will discuss the unemployment rate and wage growth below.