Goods Inflation Peaked, Housing Peaking

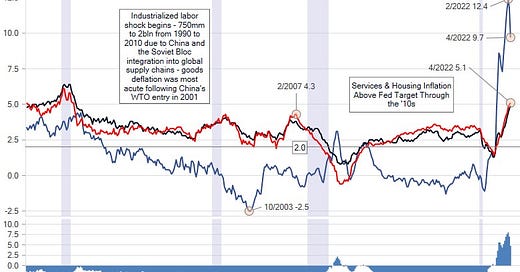

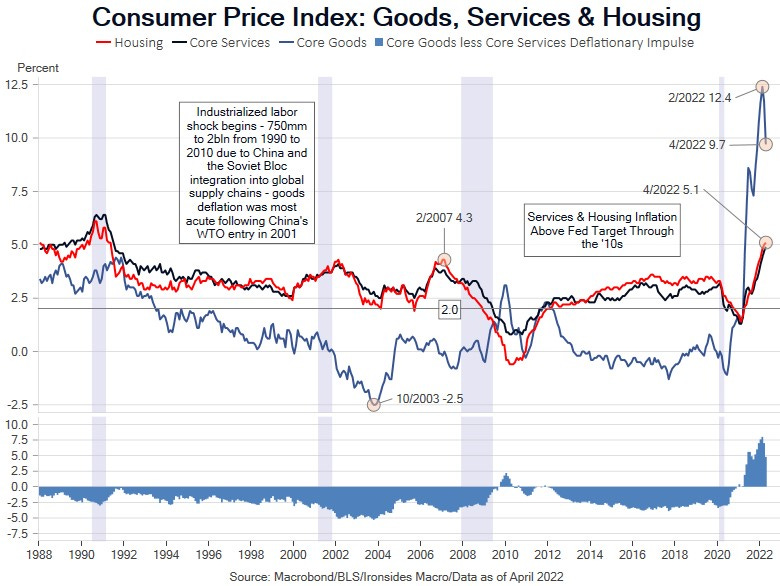

In this note we will briefly review this morning’s April CPI report, our weekly will have a more extensive discussion of the inflation outlook following PPI and import prices reports. The bottom line is that the goods price peak thesis received additional confirmation with this report and housing measures are showing evidence of slowing momentum. A change in methodology in new car prices contributed to the stronger than expected monthly core increase of 0.569%, consensus was 0.4%. Core goods increased 0.2% following a 0.4% decline in March, a 0.4% increase in February and an average increase of 1.1% in the prior four months. Consequently, the annualized rate has slowed from 12.4% in February to 9.7% in April. We do not believe April CPI changes the Fed policy path, they are likely to hike another 50bp at the next two meetings, then slow the pace of rate hikes as they accelerate balance sheet contraction. Consequently, there is no change in our view that the front-end of the Treasury market and equities are appropriately priced given our outlook for Fed policy, inflation, growth and earnings. The worst of the equity market correction is likely complete.

Our broad measures of price stability and correlation confirmed our view that we have passed peak inflation. Before we work through the details, just a note on attribution for the inflation crisis. Failure to recognize that the pandemic was the antithesis of the financial crisis in terms of the price effect, a dynamic we identified in the early days, was the largest policy mistake since the Great Inflation. The Fed does not deserve all the blame, the American Recovery Plan - $1.9trln stimulus signed in March 2021 - made a major contribution to the inflation shock. Additionally, the Yellen Treasury’s draining of the $1.8 trillion account at the Federal Reserve (TGA) from February through August 2021 that former Treasury Secretary Mnuchin had accumulated, by reducing Treasury issuance, injected more liquidity into the banking system at a faster pace than Fed QE purchases of $1.44 trillion in 2021. Goods inflation was the first order effect of the pandemic, pandemic policy drove housing and other services inflation higher. The Fed, Treasury, Congress and Administration are all complicit in the inflation crisis. Public policymakers got pandemic economics wrong, many of us in the private sector did not.