August Payroll Preview

A 'JOLT'ing report, moderating labor demand, vertical curves, cooling wage growth

A JOLT to Treasuries and Equities

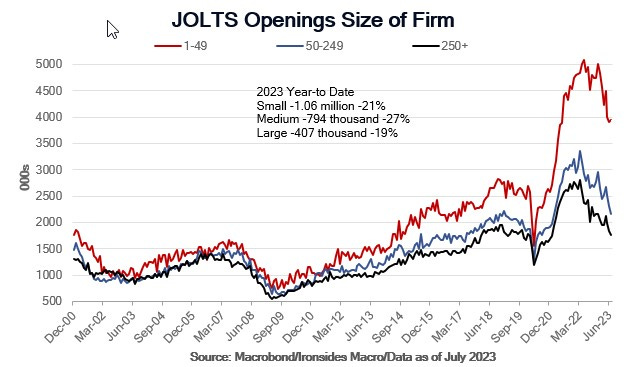

This morning’s weak July Job Openings and Labor Turnover, and August Conference Board Consumer Confidence Survey’s Labor Differential, together provided compelling evidence that pandemic related labor market tightness and record reallocation (turnover), has fully normalized. The labor market rebalancing, which Chair Powell discussed in his Kansas City Fed Economic Symposium speech, took a leap forward this morning. Before digging into details, here are some highlights. July openings were 8.827 million, far below expectations of 9.5 million, a sharp drop from 9.165 million in June, a level that was initially estimated at 9.582 million. Openings were 11.234 million in December ‘22, and a peak of 12.027 million in March ‘22. The openings to unemployed ratio was 1.97 in March ‘22, in July it was 1.23, close to last cycle’s peak of 1.22. The quits rate, a metric often mentioned in Chair Powell’s speeches, fell to 2.3%, the pre-pandemic level.

While most of the focus was on the JOLTS report, the Conference Board’s August Labor Differential — respondents characterizing jobs as plentiful less those characterizing jobs as hard to get — fell to 26.2% from 32.4% in July, which was revised sharply lower from 37.2%. The August reading is 6% below the February ‘20 reading. This series has an exceptionally strong relationship with the Bureau of Labor Statistics (BLS) U3 unemployment and U6 underemployment rates. The Bloomberg consensus forecasts for Friday are a 170,000 change in nonfarm payrolls. An unchanged 3.5% unemployment rate. A slightly softer 0.3% increase in average hourly earnings. Average weekly hours of 34.3, unchanged at last cycle’s low reading and a labor force participation rate of 62.6%. For reasons we will discuss below, we expect a softer headline nonfarm payroll figure, wage growth to begin another leg lower, and the work week to remain low. In other words, a softer than expected report.

The implications of today’s soft labor market data and an August employment report in line with our expectations are profound in terms of the monetary policy outlook: if we get a third consecutive 0.2% core CPI report, the September FOMC summary of economic projections (SEP) seems likely to confirm an end to the rate hikes.