I am on the Host Committee for the 2023 Symposium on behalf of MacroMinds, which was founded by Dean Curnutt to bring the investment community together in support of causes that expand educational opportunities for students.

I wanted to share the impressive agenda for the 3rd annual event, taking place on June 7th in NYC. It should be an excellent day of content and interaction as we support education. Please reach out with any questions around attending or becoming a sponsor.

Here is my rant sitting in Andrew Ross Sorkin’s seat this morning…

https://twitter.com/SquawkCNBC/status/1653369831016611841?s=20

Less Demand, More Supply and Churn Normalization

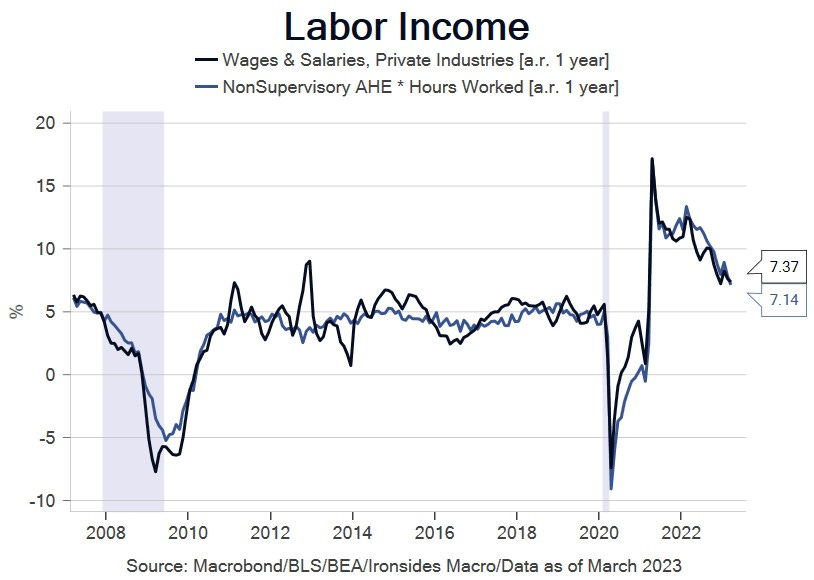

Price matters most. With that in mind, our operating thesis is that demand for labor, and the Great Reallocation, peaked in 1Q22 as evidenced by falling labor income. Average hourly earnings, hours worked and a broad range of measures of slack all point to reduced demand, more supply and a less dynamic labor market. Consensus for Friday’s April employment situation report are for an incremental reduction in demand to a 180,000 increase in total nonfarm payrolls, down from 236,000 in March and a 6-month average of 315,000. The U3 unemployment rate is expected to increase from 3.5% to 3.6%, average hourly earnings 0.3% to 4.2%, the work week and labor force participation rate forecasts are for no change at 34.4 and 62.6%. Given the weakening of demand evident in job openings and the NFIB Small Business Survey, the risks are skewed negatively in our view. Arguing against a headline miss are regional Fed manufacturing and service sector surveys, the ISM manufacturing survey, Conference Board labor differential and while some have pointed to the increase in both initial and continuing jobless claims in March and April, the increase is attributable to a change in seasonal adjustment factors. In other words, it is unclear when the increase in claims actually occurred. At the core of our view that a downside surprise is coming to a monthly payroll report soon, is deterioration in the supply of credit to the small business sector. The BLS birth/death model does not generally catch turning points, but that also implies when the model does catchup to the reality on the ground, the adjustment could be nonlinear.