Abby Normal

A real rate shock, past NAIRU, Abby Normal monetary policy, China's problems are building not receding

If you missed our review of the FOMC minutes and a discussion of the two drivers of wage growth that carry very different long run implications released Wednesday evening, please use this link.

A Real (Rate) Shock

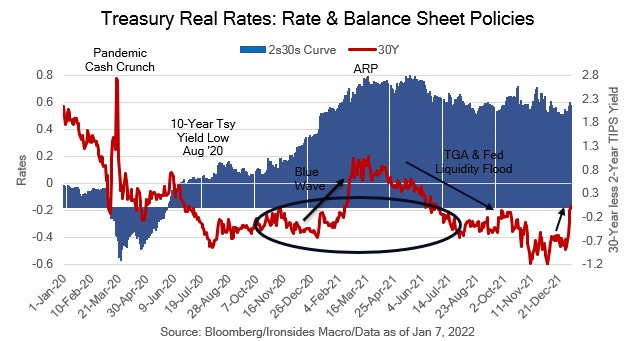

It has been quite a start to the year in real rate space, particularly in the long end of the market with 10 and 30-year TIPS yields jumping 33bp. For reference, 30bp spikes in 10-year real rates preceded risk-off episodes in February and October-December 2018 amidst global quantitative tightening. The move began prior to the release of the minutes of the December FOMC meeting, then accelerated after the minutes revealed extensive discussions of balance sheet contraction. Some contacts attributed the pre-FOMC real rate rally to corporate supply, others cited hedge funds reestablishing trades they had been stopped out of in December. In our discussions we were surprised how little support there was in the investment management community for the possibility that balance sheet contraction was likely to occur nearly concurrent with rate hikes. We strongly suspect that the magnitude of the surprise that the FOMC is seriously considering balance sheet contraction in 1H22 is a function of a lack of understanding of how the FOMC arrived at the most accommodative monetary policy since WWII.