A Narrow Path

Disruption scenarios, Fascinating Fed Speak, Domestic Demand, Payroll Preview, Reducing Risk

The Narrow Path to Higher Equities

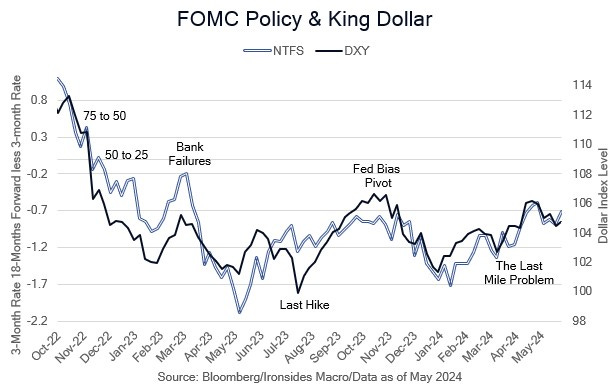

One of the ongoing debates we have had with clients throughout 2024 is whether the equity market will look through sufficiently soft labor market and aggregate demand (growth) data to trigger the start of a Fed rate cutting cycle that disinverts the 3m10y banking model proxy and recession signaling Treasury curve. During our pre-Memorial Day field trip to NYC, clients were generally on board with our view that the most probable scenario was a return to 5% for 10-year USTs that led to a 10% equity market pullback and cross-asset class risk-off episode (dollar up, commodities down, etc.), but that level of rates wouldn’t prove terminal to the economic expansion or equity bull market. As we expected, $183 billion of Treasury supply in the belly of the curve (2s, 5s and 7s) required a concession, each auction traded through the when-issued price, and the supply put even more pressure on the back end of the curve. Next week’s issuance is all bills, but the following week when BLS reports CPI on the day of the FOMC press conference, Treasury auctions 3s, 10s and 30s. Smaller QT and the Treasury buyback program will help on the margin, but next week’s employment and the following week’s inflation data need to cooperate to prevent a return to 5% on 10-year USTs.

Most clients were not overly concerned about growth with the exception of lower-income consumers, a trend most viewed as not sufficient to trigger a recession or return inflation to the Fed’s target. Thursday’s revision to 1Q GDP and first release of GDI did not change our outlook, as a modest slowing of inventory investment to the longer-run trend rate and 0.89% negative contribution from net exports due to 7.7% growth in imports, well above a tepid 1.2% increase in imports, explain the softer 1.3% quarterly annualized real GDP stepdown from 3.4% in 4Q23. The 2.8% increase in real final sales to private domestic purchasers, a modest cooling from 4Q23’s 3.3% and 3Q23 3.0%, imply domestic demand remains robust and is stronger than our trading partners. The larger than expected advanced estimate of the May goods trade deficit due to a 3.1% increase in imports and 0.5% export growth and continuation of strong Asian export growth (Vietnam this week, following South Korea, Taiwan and China), suggests US demand remains robust, though the net export channel could continue to drag down headline GDP in 2Q. That said, the initial market reaction to negative revision to consumer spending (PCE) and soft April report on Friday morning, that led to a 0.7% reduction in the Atlanta Fed personal consumption expenditure (PCE) 2Q tracking model, was consistent with our view that a deterioration in the growth outlook will lead equities lower. We will discuss the topic later in the note.

Next week’s May employment report and the following week’s May CPI and FOMC meeting loom large over our two potential disruption paths, a real rate driven bear steepening of the Treasury curve or growth scare that pulls forward market expectations of rate cuts. Thus, the question of whether the equity market would look through a growth scare is crucial. Thursday morning’s price action following the modest negative revision to GDP and slightly cooler deflator, 7bp lower in the belly of the Treasury curve, and every sector higher except tech and communication services, suggests the initial reaction to a second consecutive softish employment report will be the look-through “Fed easing will make every ok” outcome. Friday’s reaction to marginally softer April spending suggested our fears of a growth scare are warranted. Keep in mind, although we expect a fairly quick Fed policy reaction to a larger than expected increase in the unemployment rate (above 4%), Fed policy moves at the speed of a battleship. In other words, it always lags markets. Consequently, we remain unconvinced that employment and growth data sufficiently soft to pull forward rate hikes will not catch equity investors by surprise and cause a pullback. As a consequence, we are making a modest tactical change to our sector and asset allocation recommendations this week.

In this week’s note we discuss an interesting week of Fed speak, we dig into the labor market outlook, which we will expand on Tuesday following JOLTS with a payroll preview note. We will also dig into the GDP revision and first look at GDI and the NIPA corporate profits measure, and end with our tactical sector and asset allocation change due to our view that the path to a continuation of the rally is narrowing.